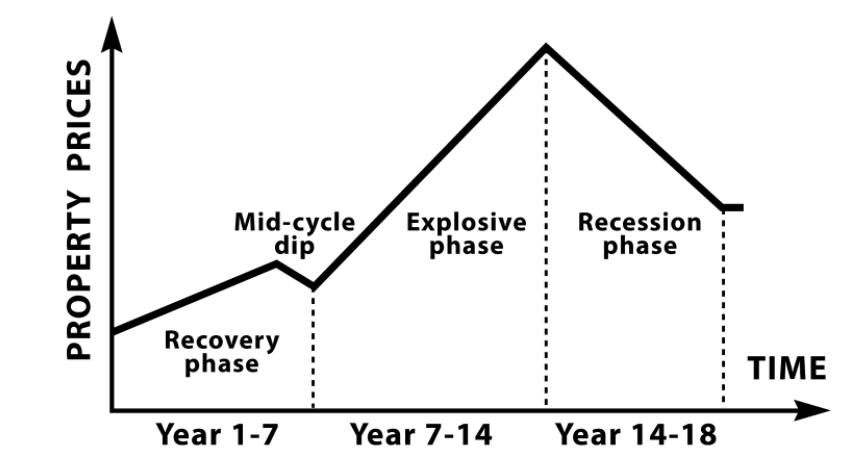

You may have heard investors talk about the 18-year property cycle, also known as the property clock. This is a framework used to understand the long-term trends in the property market. It says that the UK property market experiences a predictable pattern of boom and bust phases over an approximate 18-year period.

Also within that cycle property prices double in value. So when considering when is the right time to buy to avoid making a loss one answer is it doesn’t matter as long as you can afford to keep and maintain the property for a few years. Prices will rise for 13 years out of every 18 according to the framework.

The cycle typically consists of four main phases:

Recovery (Years 1-3): Following a period of economic downturn or stagnation, property prices begin to rise. This phase is characterized by increasing demand, often fueled by factors like low-interest rates, economic growth, and favorable market sentiment.

Expansion (Years 4-7): This phase sees continued growth in property prices and market activity. Demand outpaces supply, leading to a surge in property values. Developers invest heavily in new construction projects.

Hyper Supply (Years 8-12): As a result of the previous expansion, there's an oversupply of properties. Prices plateau or start to decline. This phase can be challenging for property developers and speculators.

Recession (Years 13-18): The market experiences a significant downturn. Property prices drop, demand decreases, and many projects face financial difficulties. This phase may be triggered by factors like economic recessions, high-interest rates, or geopolitical events.

It's important to note that while the 18-year property cycle provides a useful framework for understanding market trends, it is not a rigid rule. External factors such as government policies, global events, and technological advancements can influence the timing and intensity of these phases.

So when is the best time to buy within the cycle ? Well in short when most people are choosing not to buy that’s when you can get the best prices. The Recession Phase and the start of the Recovery Phase is a strong buyers market providing the highest supply and best prices.

And what Phase are we in now ? The last Cycle Recession Phase started in 2008 and 18 years from then would mean the next Recession Phase would start in 2026. However the cycle is only a framework and the current cycle has been affected by major economic events like Brexit, COVID and Ukraine. The Explosive phase may well have been shorter than normal ending in October last year and we may well be 1 year into the Recession Phase already. If so now is a good time to buy to get the best price.

Steve McCullough is retained by Investors and Developers across Dorset to identify and acquire property investments. To Speak to Steve or any of our Property Professionals at Clarkes please call 01202 533377.